A lifeline has opened up for Americans who, despite having health insurance coverage, struggle to afford routine healthcare. Most insurance policies make you pay all your bills until you spend enough to reach a deductible; once that deductible is reached, your insurance will pitch in to help cover your costs. Reaching this deductible, though, can take thousands of dollars.

But impossibly high deductibles are less of an issue with expanded bronze plans, a new type of Affordable Care Act coverage that debuted in 2018.1

What Is a Bronze Plan? A Look at Metal Levels

One recent healthcare win for consumers is the requirement that health insurance plans share a few things in common so that they’re easier to shop for. Now, Americans can compare insurance that falls into one of four “metal levels” – bronze, silver, gold, and platinum.

Metal levels determine the overall average percentage of medical costs that the plan pays. On average, metal level plans cover anywhere from 60% (bronze plan) to 90% (platinum plan) of enrollees’ total costs (this applies across a standard population of enrollees, rather than to each individual enrollee).

Thirty-one percent of people who buy their own health insurance pick a bronze plan.2

Plans in the higher metal level categories will generally offer more robust coverage — including lower deductibles and more services covered pre-deductible — through the federally mandated upper limit for out-of-pocket costs ($8,150 in 2020) applies to plans at all metal levels. Most bronze plans tend to have an out-of-pocket cap equal to the limit set by the federal government, but there are also lots of bronze plans that are HSA-qualified high-deductible health plans, and those have lower out-of-pocket caps under IRS rules (no more than $6,900 in 2020).

What Is an Expanded Bronze Plan?

Access to Benefits Before Meeting Your Deductible

An expanded bronze plan is unique because it lets you pay fair prices for certain essential health benefits, even before you meet your deductible. Expanded bronze plans are great for people who don’t expect to incur major healthcare expenses, but who still intend to make significant use of their plan from the first day that insurance begins. For something like a sprain or cold, a doctor’s visit could cost you a flat $35 per visit on an expanded bronze plan instead of the full price.

Hard to Find

There are a few reasons why expanded bronze plans might sound unfamiliar. In addition to naming inconsistencies (some sources call them “extended bronze” plans) and the fact that they’re fairly new, expanded bronze plans are difficult to identify. On paper, an expanded bronze plan might look the same as a regular bronze plan. Both designs are listed under the bronze metal type, and expanded bronze plans don’t always advertise their “expanded” status.

Regular Bronze Plans VS Expanded Bronze Plans

Regular bronze plans still come with all the benefits of Obamacare, like free preventive care. But bronze plans are designed to cover roughly only 60% of enrollees’ total costs (that means they have an actuarial value of about 60%), and a typical bronze plan tends to require the member to meet the deductible before the plan starts to pay for non-preventive services.

Expanded bronze plans still have actuarial values that are in roughly the same range, but they can go a little higher as well. Bronze plans must have actuarial values that can only vary from 56% to 62% (i.e., very close to their 60% target), while expanded bronze plans can have an actuarial value that ranges as high as 65%. A plan with an actuarial value of 65% would cover an average of 65% of total costs for a standard population. This additional coverage can be achieved by adding extra pre-deductible benefits.

With an expanded bronze plan, you can be protected from certain runaway costs before you hit your deductible. Flat fees or co-payments for covered services mean that you don’t have to spend a lot on your own before health insurance savings kick in. Those expanded services give the plan a higher actuarial value as well, meaning a higher percentage of total average costs would be covered.

If you weren’t sold on a health insurance plan before, expanded bronze plans might sweeten the deal. Let’s take a more detailed look at the coverage these expanded bronze plans provide.

What’s in an Expanded Bronze Plan?

Coverage for at Least One Major Essential Health Benefit

Expanded bronze plans are required to provide coverage for at least one of several major essential health benefits before meeting your deductible. These plans are designed to help enrollees meet basic health needs, while still keeping the low monthly cost of a typical bronze plan.

For expanded bronze policyholders, this means that one or more of your major healthcare services are covered from day one, even if you haven’t spent enough to reach your deductible. This benefit is limited to primary care visits, specialist visits, inpatient hospital services, generic drugs, specialty drugs, preferred branded drugs, and emergency room services. Not all services are covered by all plans before your deductible.

That Coverage, Though, May Not Be Covered in Full

Notably, the major healthcare services which bronze plans cover before policyholders meet their deductible may not be covered in full. For example, an expanded bronze plan that covers doctor’s visits before a deductible could still charge a $35 copayment for each appointment.

The coverage provided for those appointments may not cover the full cost of care, but it’s still valuable. For instance, an expanded bronze enrollee could have to pay a total of $185 after a light injury – $35 to see a primary care physician and two $75 specialist visits after a referral. The same incident in a regular bronze plan might see an enrollee pay 100% out-of-pocket before they reached their deductible, costing around $625 (for one $125 doctor visit and two $250 specialist visits).

Free Preventive Care

As with all bronze plans and other major medical plans, expanded bronze plans must offer free preventive care whether or not a policyholder’s deductible has been reached (as required under the Affordable Care Act).

Major Surgeries Are Still Expensive

Under an expanded bronze plan, your deductible for expensive medical bills like hospitalization could still be quite high. Expanded bronze coverage will help you pay for a few chosen services before you hit your deductible, but you’ll still have expensive medical bills to pay if you get a serious injury, or require surgery before meeting your deductible.

How to Find Expanded Bronze Plans

You won’t see the difference between an expanded bronze plan and a regular bronze plan right away. You might be lucky enough to find a plan in your area with “expanded bronze” in its name, but most plans don’t advertise their expanded bronze status.

Compare The Benefits

To single out expanded bronze plans from the rest, you’ll just need to search for bronze plans and read each plan’s Summary of Benefits in order to recognize the difference. You’ll know if a plan is an expanded bronze plan if its Summary of Benefits tells you that a major health benefit (besides preventive care) is covered before you’ve reached your deductible. For example, a bronze plan that claims to offer primary and specialist visits at “no charge after deductible” is considered a regular bronze plan since you’d have to pay the full costs of those visits until you reach your deductible.

Savings Before The Deductible

A bronze plan with “no charge after deductible” might seem more attractive than a plan with a $35 charge for each doctor’s visit. But that bronze plan with no charge after deductible will require you to pay the full deductible ($6,000 in this case) in addition to your monthly premiums before it shoulders the cost of your care.

Where Are Bronze Plans Available?

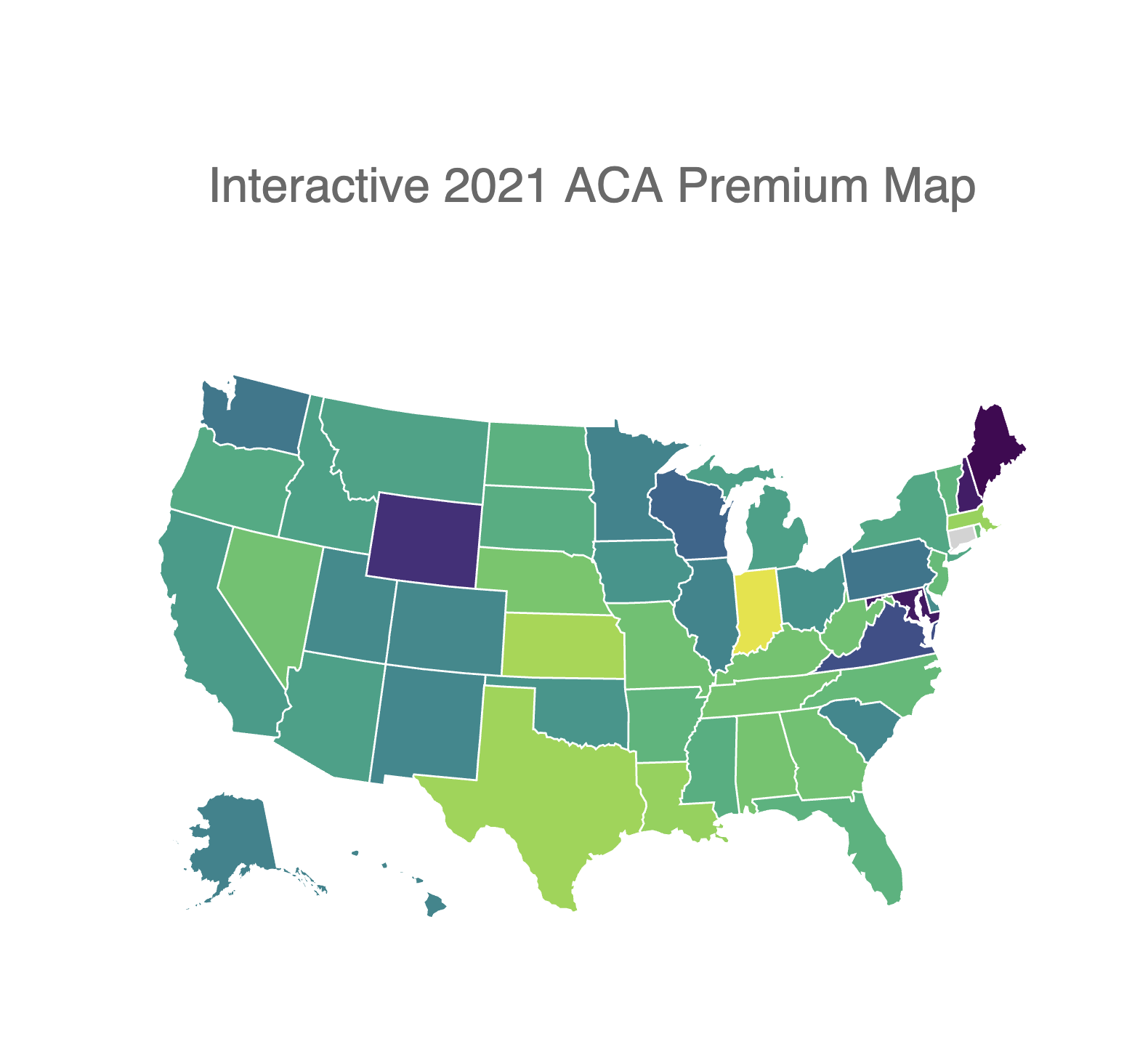

Since expanded bronze plans can be more or less inclusive than regular bronze plans, prices between the two may vary. Average costs for plans differ widely in the states that we examined.

As of 2020, expanded bronze plans are available in all 38 of the states that use HealthCare.gov, although plan availability can vary within each state.

Some of the states that run their own exchanges offer expanded bronze plans. But some others use standardized plan designs to ensure that residents have access to plans that cover certain services pre-deductible.

Bronze or Silver Plan?

Depending on your annual income, you may qualify for Obamacare tax credits. You can use these premium tax credits – often referred to as “Obamacare subsidies” – to make your monthly bronze plan payments.

Tax credits are determined by the price of the second-lowest-cost silver plan available to you. The amount of the credit is the cost of that plan, minus your expected contribution to monthly premium payments. Your contribution is determined by a number of factors, including your income and family size. Tax credits are generally available to those making between 100% and 400% of the federal poverty level (the lower limit is 139% of the poverty level in states that have expanded Medicaid, as Medicaid is available below that level). Health insurance websites, including HealthCare.com’s plan selector, can automatically determine the size of your credit.

Silver plans are different than bronze plans in that they may apply cost-sharing reductions (sometimes called “extra savings”). You’ll have a lower out-of-pocket maximum and lower prices for basic medical treatments. To get a silver plan with cost-sharing reductions, you’ll need to make between 100% and 250% of the federal poverty level.

Since premium tax credits are based on silver plans – which are somewhat more expensive than bronze plans – if you qualify for a high amount of premium tax credits, there’s a chance you could get a bronze plan for free! According to the Kaiser Family Foundation, around 4.7 million uninsured people (or 28% of uninsured Americans who can purchase plans through the Health Insurance Marketplace) could qualify for a free bronze plan.3

Is a Bronze Plan Right for You?

Bronze plans may not always be a great deal. You may have a considerable deductible before using your plan, although young people and those who rarely use care may prefer plans with a high deductible.

Fortunately, bronze plans charge you low monthly premium costs compared to other options. If you qualify for enough subsidies, it’s even possible to get a bronze plan for free. Combining low premiums with the extra benefits in an expanded bronze plan could drastically lower your healthcare costs.

Expanded bronze plans solve two major criticisms of health insurance in America – namely that plans offer inadequate coverage by making consumers responsible for too much cost-sharing, and that plans leave enrollees with a sizable deductible before meaningful coverage begins.